The government recently distributed eBeliaRahmah RM200 eWallet credit to youths aged 18 to 20 and eligible full-time students in our country. However, since its disbursement, there have been many stories of recipients getting scammed when trying to cash out the credit, something that the initiative expressly said NOT to do.

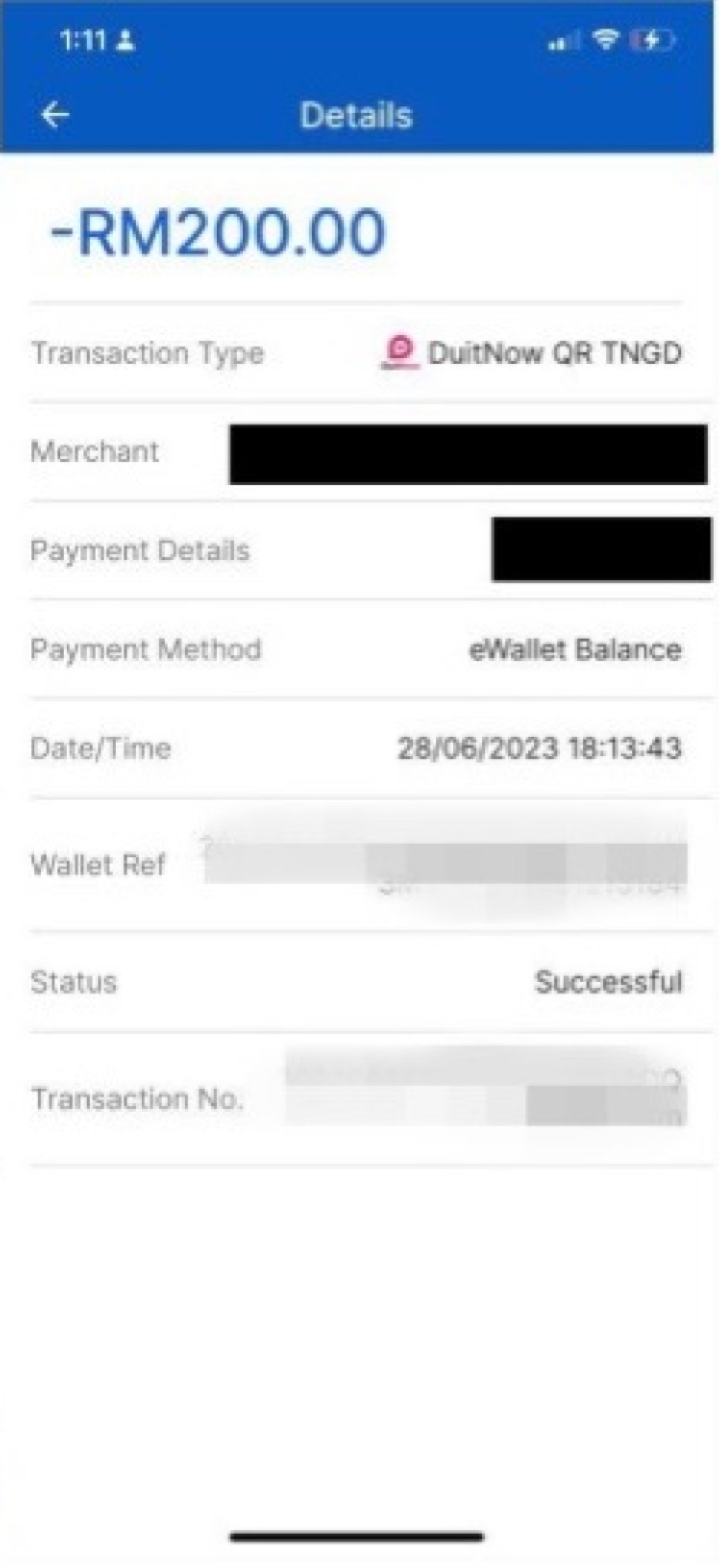

In its terms and conditions, eBeliaRahmah stressed that the aid should not be cashed out or transferred peer-to-peer. Well, this must be something this 20-year-old Malaysian student missed out on, as she did both and ended up getting duped by an ‘online service’ offering cash in exchange for the eWallet credit.

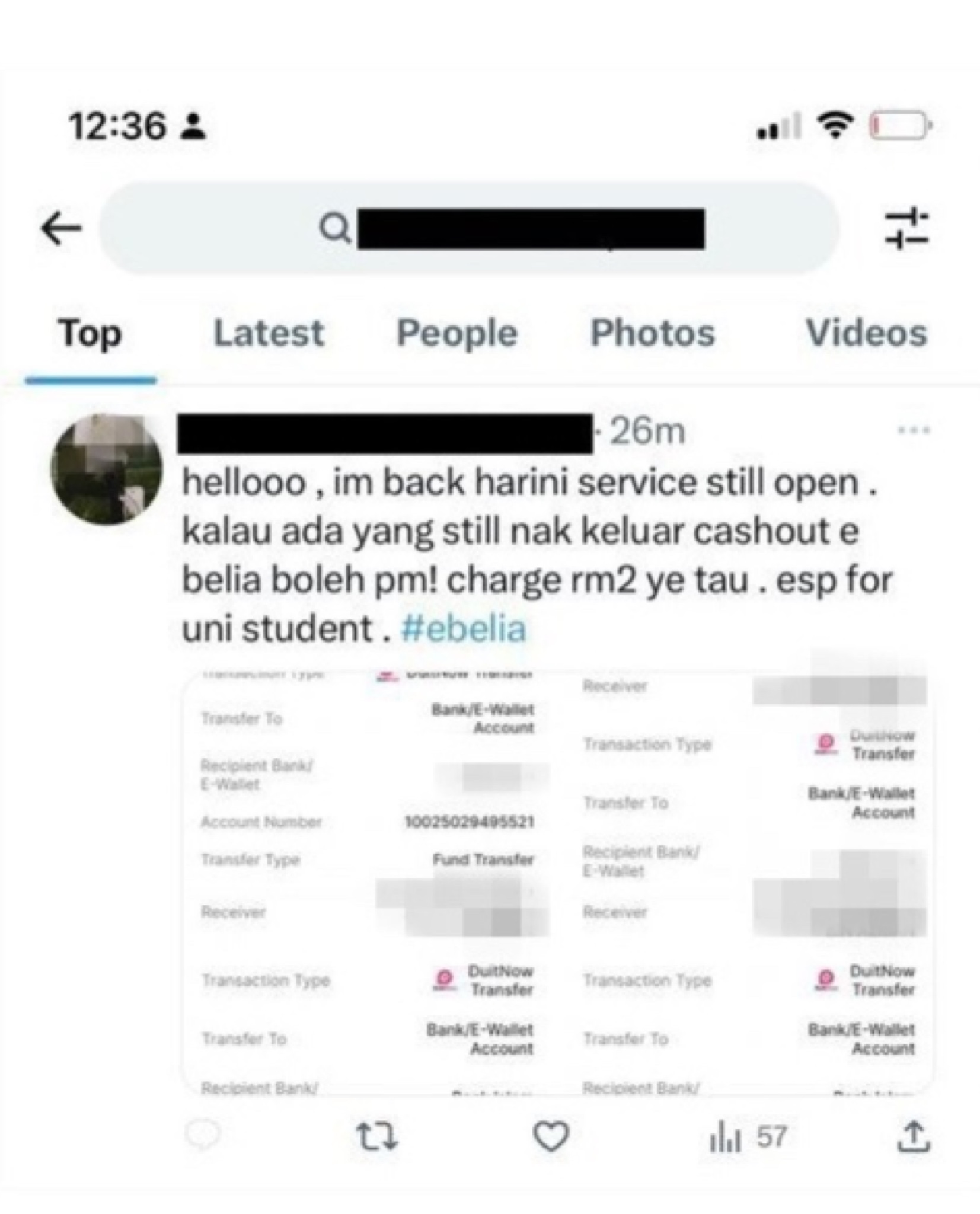

As reported by Bernama, the university student, known only as Nur, lost her RM200 eBeliaRahmah credit in the blink of an eye after falling prey to the fake service. Stumbling onto a Twitter user claiming to provide an “eBeliaRahmah credit-to-cash” service, she contacted the person and blindly followed his instructions to transfer her RM200 eBelia credit to his eWallet account.

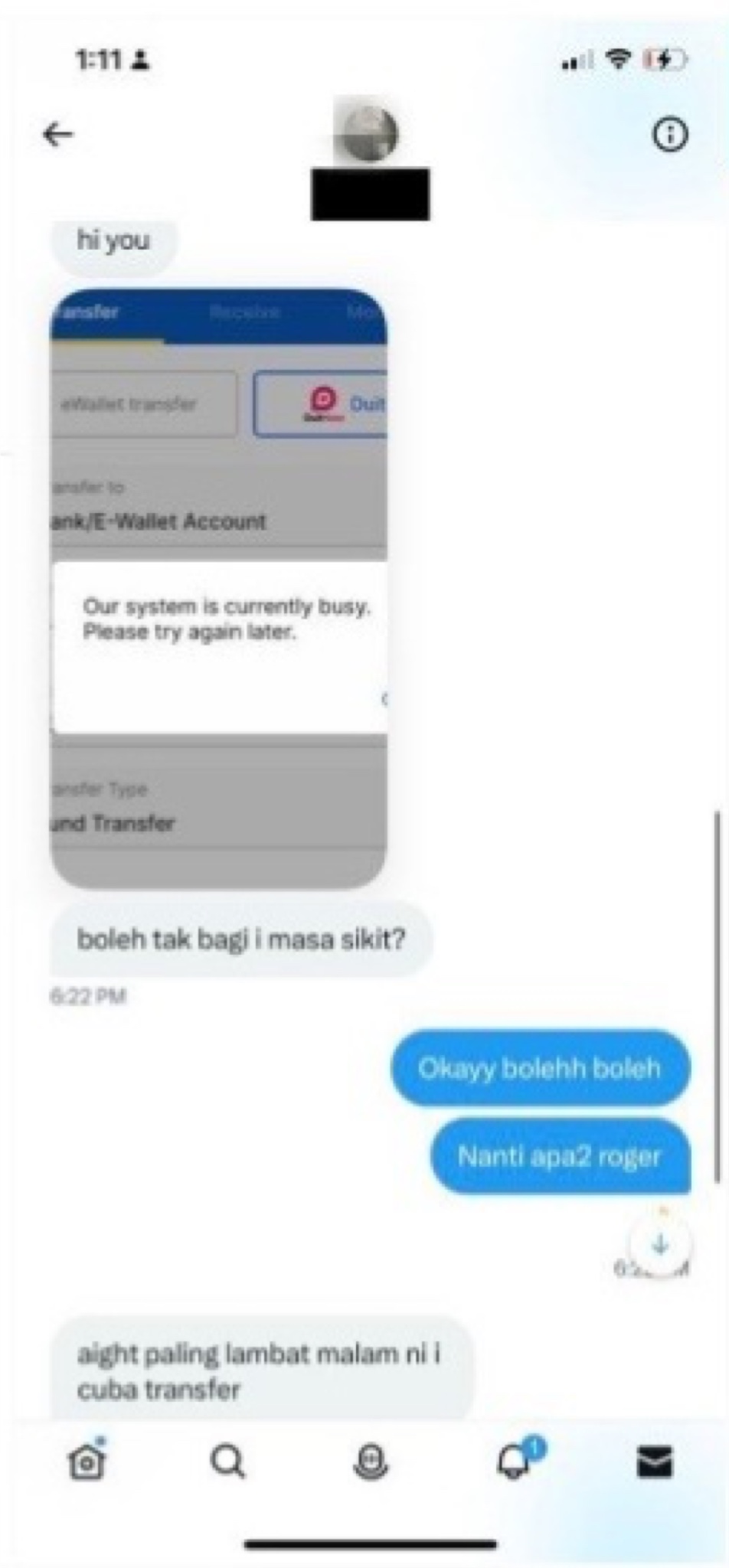

Later that day, the man shared a screenshot with Nur, telling her that the system was busy and that he couldn’t transfer the money to her account. The student only realised she was duped by the scammer after finding that he had deactivated his Twitter account the next day.

Following Nur’s story and other similar tales, the Finance Ministry (MOF) released a statement reminding beneficiaries to not put themselves at risk of falling prey to scams by attempting to cash out the RM200 eBeliaRahmah credit. Instead, they should use the funds at over 1.7 million businesses nationwide, and to pay for services and online purchases through DuitNow.

MOF further asserted that the attempt to cash out the funds defeats the very intended purpose of the programme. The initiative is aimed to help youth aged 18 to 20, and full-time higher education institution (IPT) students to familiarise themselves with cashless payment facilities and at the same time, ease their financial burden.

So, what do you guys think of the whole situation? Share your thoughts with us in the comments below and stay tuned to TechNave for more tech stories such as this.

COMMENTS