Today, GX Bank Berhad (GXBank) has announced its beta app and will roll out to selected 20,000 Malaysian users. The GXBank was in alpha testing amongst employees of the bank and partners before going public. But what is GXBank? Well, read on to check out the details.

For the uninitiated, the GXBank app is Malaysia's first digital bank that is compatible with all mobile phones with the latest operating system. Offering digital banking services to users of all financial capabilities and tech understanding, the app also includes an easy navigation interface with key safety functions to secure users’ trust and security.

From the words of Fadrizul Hasani, Chief Technology Officer of GXBank, he ensured that the GXBank app is in line with the technical requirements of a digital bank and prioritising the safety and security of users’ data and funds. During the beta-testing phase, users will be able to create a GXBank Savings Account and up to 10 “Pockets.”

“Pockets” are savings goals to encourage users to cultivate a saving behaviour for specific needs and dreams. Users can save up for a variety of purposes such as their retirement plan, an upcoming holiday or even for a new home. Money parked in “Pockets” will earn daily interest of up to 3% p.a., and users can monitor their savings progress and receive periodic tips to fast-track their savings goals.

Aside from being licensed by Bank Negara Malaysia, GXBank also:

- Assures all deposits are protected by Perbadanan Insurans Deposit Malaysia (PDIM), up to RM250,000 for each depositor

- Enabling users to lock and secure their accounts if they observe any fraudulent or unauthorised transactions

- Limiting daily spending to help users not overspend

On top of that, other benefits users can enjoy are:

- RM20 cashback with a minimum deposit of RM100

- Waiver on RM1 processing fee for cash withdrawals at MEPS automated teller machines (ATMs) nationwide (coming soon)

- Unlimited cashback every time they spend with our debit card (coming soon)

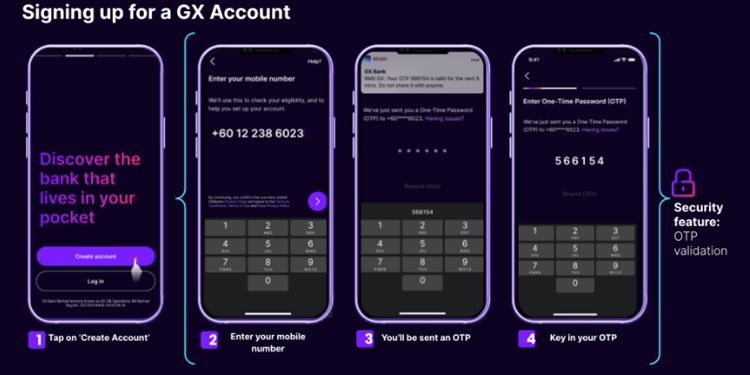

GXBank promises users a seamless and hassle-free eKYC (electronic Know Your Customer) and account setup process. To set up an account, users will need to follow these four simple steps:

- Download the app from the Google Play Store or Apple App Store

- Upload a digital copy of the national identity card (MyKad)

- Complete the eKYC process as stated in the app

- Add a minimum of RM10 into the savings account and set up Pockets (if so desired)

For the existing Grab users, the GXBank app can be accessed through the Grab App itself. Malaysians interested in being part of subsequent testing phases can register here.

COMMENTS