Sourced from Wikipedia

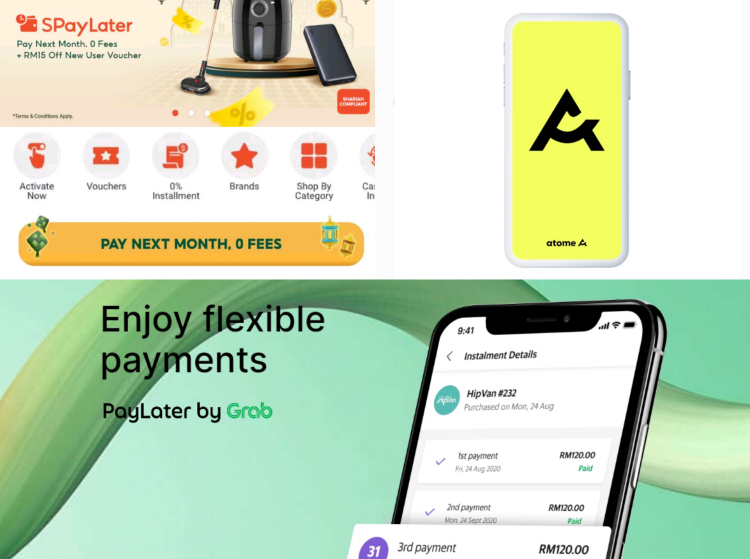

Recently, Nor Rafidz Nazri of Bank Negara Malaysia (BNM) announced that a special body to oversee entities engaged in providing Buy Now Pay Later (BNPL) would be set up while the Consumer Credit Act (CCA) would impose tighter regulations on BNPL credit providers. Major online BNPL players that were named included Shopee, Grab and Atome as they make up 97% of BNPL providers in Malaysia.

In addition, the Consumer Credit Oversight Board task force (CCOB), led by the Finance Ministry, BNM, and the Securities Commission Malaysia, will develop a comprehensive framework to regulate BNPL practices. This is mainly in response to rising debt in Malaysia’s youth, particularly when financing motorcycles through these BNPL credit agencies. Non-governmental organizations and consumer associations have proposed tighter loan terms from credit providers to address this issue.

Shopee, Grab and Atome are currently the 3 major BNPL providers in Malaysia

To help provide more information and avoid a next generation of Malaysian youth heavily in debt, BNM’s Financial Education Network (FEN) aims to empower financially savvy Malaysians with financial education modules as elective subjects in higher education institutions and an online program called FEN Proactive for final-year students.

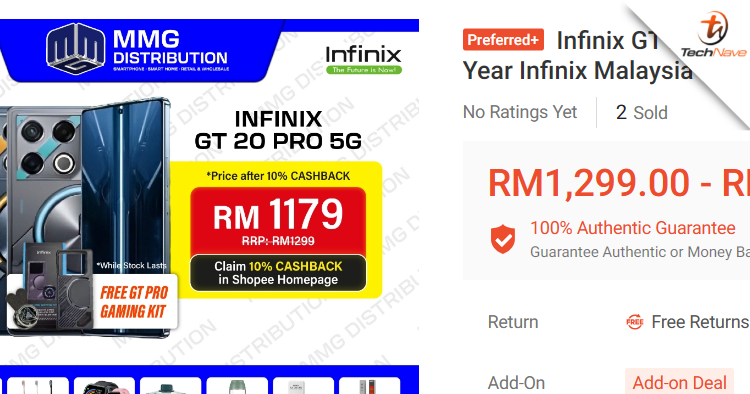

However, if used well and paid off diligently, we think such BNPL services offer a valuable alternative payment option for Malaysians. What do you think? Have you used BNPL to buy something lately? How did that work out for you? Share your experiences in the comments below and stay tuned to TechNave.com

COMMENTS