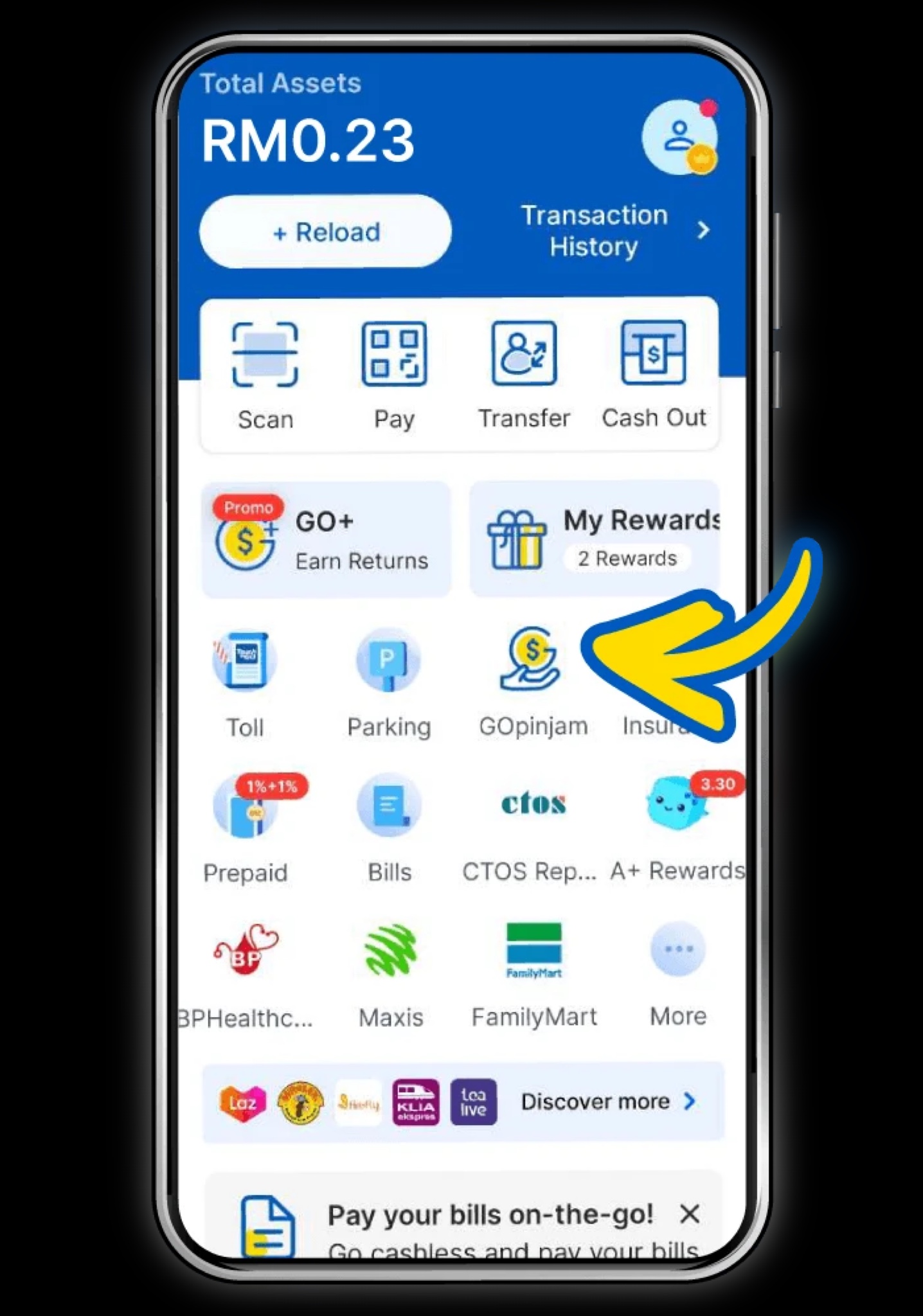

Last year, TNG Digital Sdn Bhd in collaboration with CIMB Bank Sdn Bhd introduced GOpinjam, a short-term personal loan through the former’s TNG eWallet app. Well, despite initial controversy regarding its high-interest rate, the service has been really popular among Malaysians who need fast cash.

According to the Ministry of Finance (MOF), a total of 88,620 people took GOpinjam loans as of end-March 2023, amounting to RM91.1 million. Furthermore, the short-term loan service was especially popular with youths.

Specifically, youths under 30 make up 55 per cent of GOPinjam’s total customers. The average loan amount for those in this age category is RM1,500 per person.

MOF revealed the matter in reply to a question from Batang Sadong Member of Parliament (MP) Rodiyah Sapiee in Parliament. She had previously asked about the number of borrowers and the average amount of approved financing applied for by the public, especially youths in making personal loans directly with non-financial institutions.

In the reply, MOF also stressed that all financial institutions are required to comply with the requirements outlined by Bank Negara Malaysia (BNM). This is to ensure fair treatment of consumers and protect them from excessive debt burdens and financial difficulties.

So, what do you guys think of the GOpinjam service? Share your thoughts with us in the comments below and stay tuned to TechNave for more tech news locally and from abroad.

COMMENTS