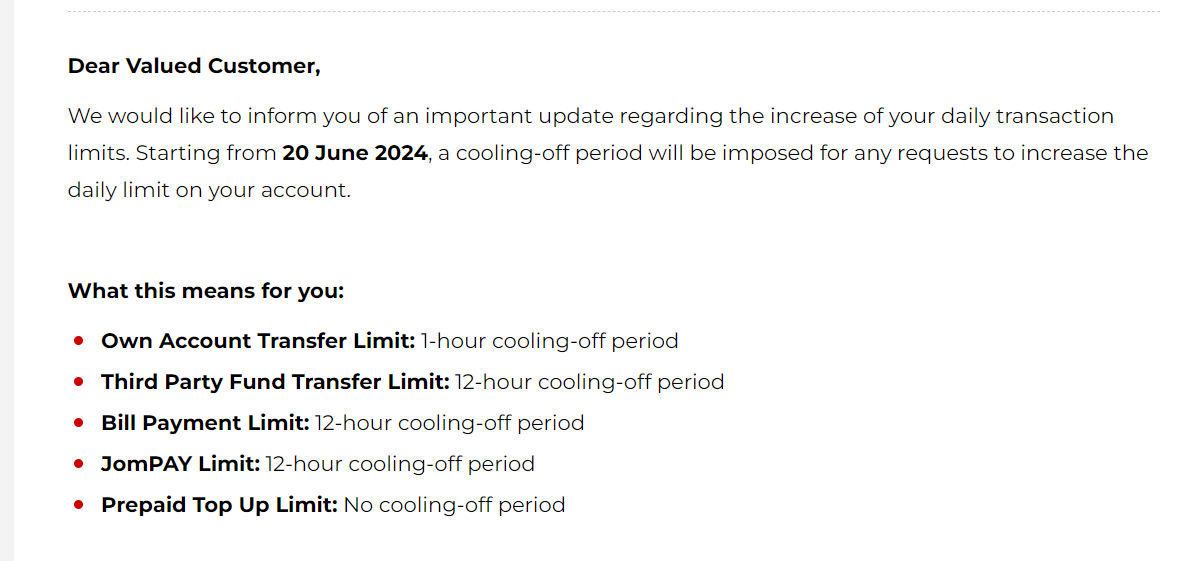

Public Bank has announced that it will implement a cooling-off period for requests to increase PBe daily transaction limits starting June 20, 2024. The move is aimed at improving account security and preventing potential fraud risks. So, what should you know about it?

According to the new regulations, customers should pay attention to the following matters when adjusting their transaction limits:

- Transfer limit for own accounts: 1-hour cooling-off period required.

- Third-party transfer limit: subject to a 12-hour cooling-off period.

- Bill payment limit: Subject to a 12-hour cooling-off period.

- JomPAY limit: subject to a 12-hour cooling-off period.

- Prepaid top-up limit: Not subject to a cooling-off period.

In addition, the reduction of PBe transaction limits is not subject to this cooling-off period. Public Bank said this measure is to better protect your account security and prevent fraudulent activities. That’s a neat addition.

Moreover, Public Bank thanks its customers for their understanding and cooperation and stresses that safety and security are its top priority. If you have any questions or require further assistance, they may email [email protected]

What are your thoughts about this news? Stay tuned for more news and updates like this at TechNave!

COMMENTS