Today, the Bank Negara Malaysia (BNM) has officially announced five successful applicants for the digital bank licence. If you recall back, a total of 29 applications were sent but only a handful got approved by the Minister of Finance Malaysia.

From the report, Boost Holdings and RHB Bank Berhad, Sea Limited and YTL Digital Capital Sdn. Bhd. and KAF Investment Bank Sdn. Bhd. are majority-owned by Malaysians (licensed under the Financial Services Act 2013 (FSA). The other two are licensed under the Islamic Financial Services Act 2013 (IFSA) which are AEON Financial Service Co., Ltd., AEON Credit Service (M) Berhad and MoneyLion Inc. and KAF Investment Bank Sdn. Bhd.

So what does this mean for you and me? According to Bank Negara Malaysia Governor Tan Sri Nor Shamsiah, the successful applicants for the digital bank licences "are expected to further advance financial inclusion" as well as provide a safer and more convenient way to transact. Shamsiah hopes that this can help Malaysia to overcome geographical barriers, reduce transaction costs and promote better financial management.

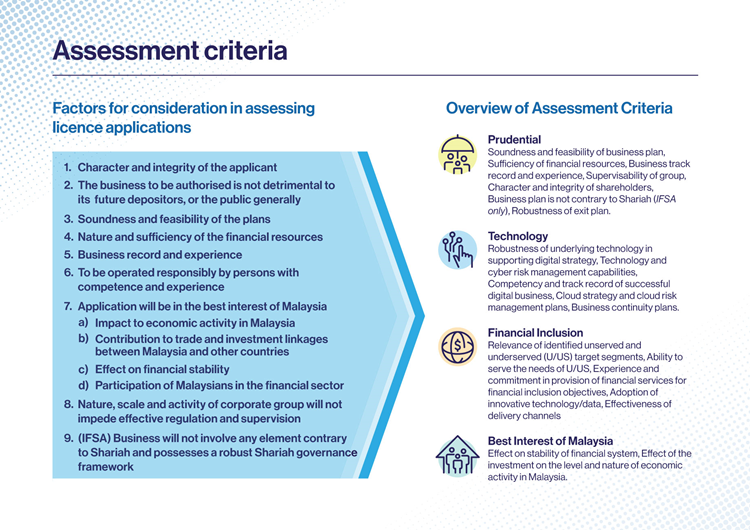

How the five applicants got approved for the digital bank licences depends on several factors by the BNM. This includes the "character and integrity of the applicant", "soundness and feasibility of the plans", and their "business record and experience". A total of four levels of assessment were executed, with the assistance of a cross-functional technical team, a review team and internal independent observers from BNM’s risk and legal departments.

The successful applicants are going to undergo a period of operational readiness. BNM will be validating the process through auditing which can take between 12 to 24 months. Stay tuned for more trending tech news at TechNave.com.

COMMENTS