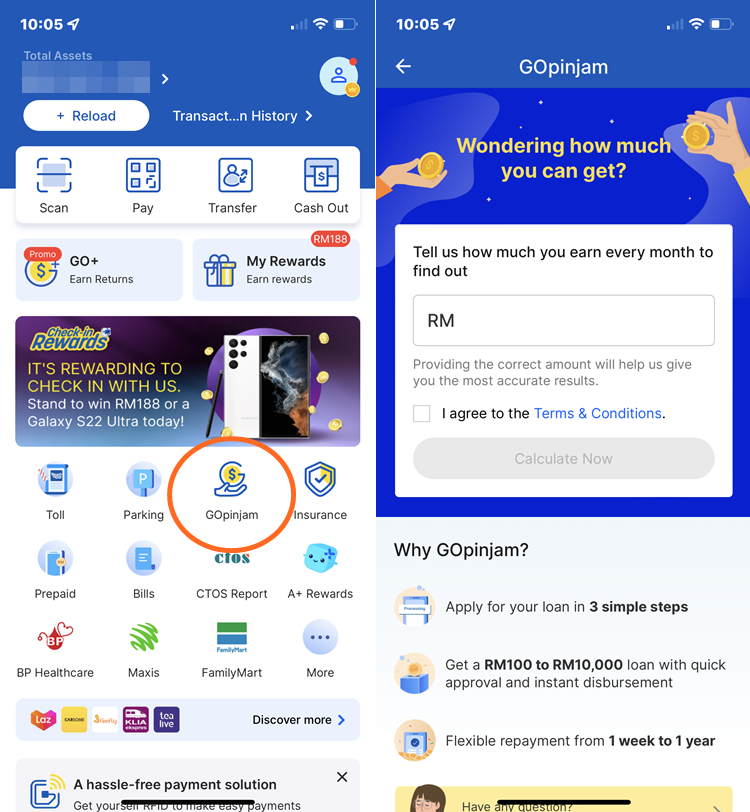

If you didn't notice, there is a new GOpinjam function in your Touch 'n Go (TnG) eWallet app. What might this do, you ask? Well, it's a new digital financial service to assist Malaysians with personal loaning online. As long as you have updated it to the latest version, GOpinjam offers personal loans from as low as RM100 to a maximum of RM10,000.

According to TnG Group, the repayment period for these loans can range from a week to a year, with no hidden fees of early settlement charged. To further promote the inclusion and accessibility of this launch, potential borrowers will require a minimum monthly income of only RM800 to gain access to GOpinjam.

On that note, GOpinjam is developed in partnership with CIMB Bank. This marks it as the first lending offering that would allow users to borrow from as low as RM100. This is done through CIMB Bank's e-Zi Tunai Personal Loan which has been approved by Bank Negara Malaysia.

All first-time users must submit either a one-month payslip or the latest EP statement along with basic information or the loan application. It doesn't take long for first-time users to know if they have been approved but if not, then it's the next business day upon full and accurate submission of the income documentation. After approval, the funds go into either the TnG eWallet app or the CIMB Bank account. Returning users can apply and get an instant loan disbursement without the submission process.

GOpinjam is available effective immediately to TnG eWallet users who are Malaysian citizens above 21 years old. For more information and updates about GOpinjam, you can visit www.touchngo.com.my and stay tuned for more trending tech news at TechNave.com.

COMMENTS