When you’re in need of money for emergencies, you probably would think of the options like people around you, banks and loan sharks. However, have you ever thought of loaning money from a smartphone company? Today, realme has launched a comprehensive financial service platform named realme PaySa in India that will assist your financial status.

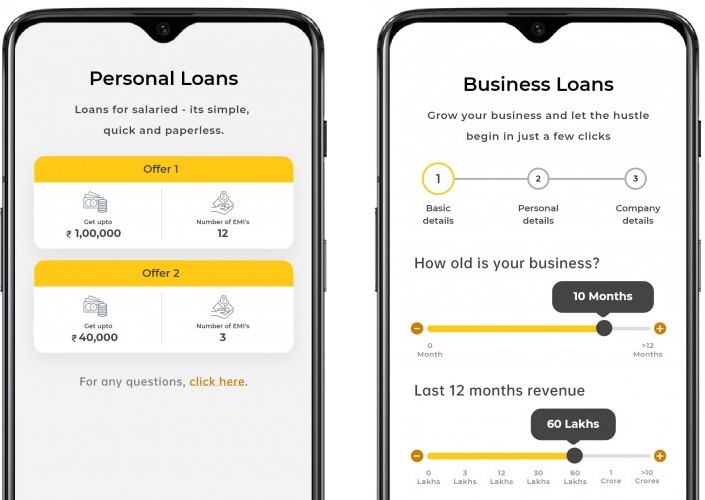

Alongside the launching of realme X2 and realme Buds Air, it was unexpected that the smartphone manufacturer is heading towards a different direction by announcing this financial service platform. The realme PaySa will be offering 4 main features including free credit reports, personal loans, business loans, and screen insurance

realme has partnered with a financial company CreditMantri in India to provide three free credit reports in three months. Users are able to get the reports in less than a minute by using the platform. Usually, getting credit reports comes with a price and realme is doing this for free three times!

Another feature is you will be able to loan money from the realme PaySa for either personal use or business purpose. The personal loan ranges from 8,000 INR (~RM46.66) to 1,000,000 INR (~RM58320.38) and it requires limited paperwork. Debtors will have the option of repaying the amount in three to 12 months. For business, the loan can be up to 100,000,000 INR (~RM5833286.11), with the repayment period ranging from one to five years.

Other than that, users can also purchase screen insurance for their realme smartphones through the service. For the one year plan, they can get their broken screen covered twice with the price of 1,000 INR (~RM58.33).

It is claimed that all the data will be stored in India with the highest standards of IT security. Let us know what you think of the realme PaySa on our Facebook page! Stay tuned to TechNave.com for more tech news.

COMMENTS