The concept of "digital bank" is relatively new to Malaysians. But many have become aware of it, especially with the introduction of two digital bank operators that have already started their services for the public, namely GXBank and AEON Bank. The third one is Boost Bank, which debuted recently.

As you can see, the industry is gaining ground in Malaysia. But what is a digital bank and how does it differ from regular ones? Read on for some details on what you need to know about digital banks.

What is a digital bank?

Digital banks are licensed banks that provide most of the banking services by conventional banks. But as the term suggests, digital banks operate digitally. While a regular bank will have physical branches and ATM machines, digital banks don't have any physical facilities. Instead, all banking tasks can be done on your smartphone or computer.

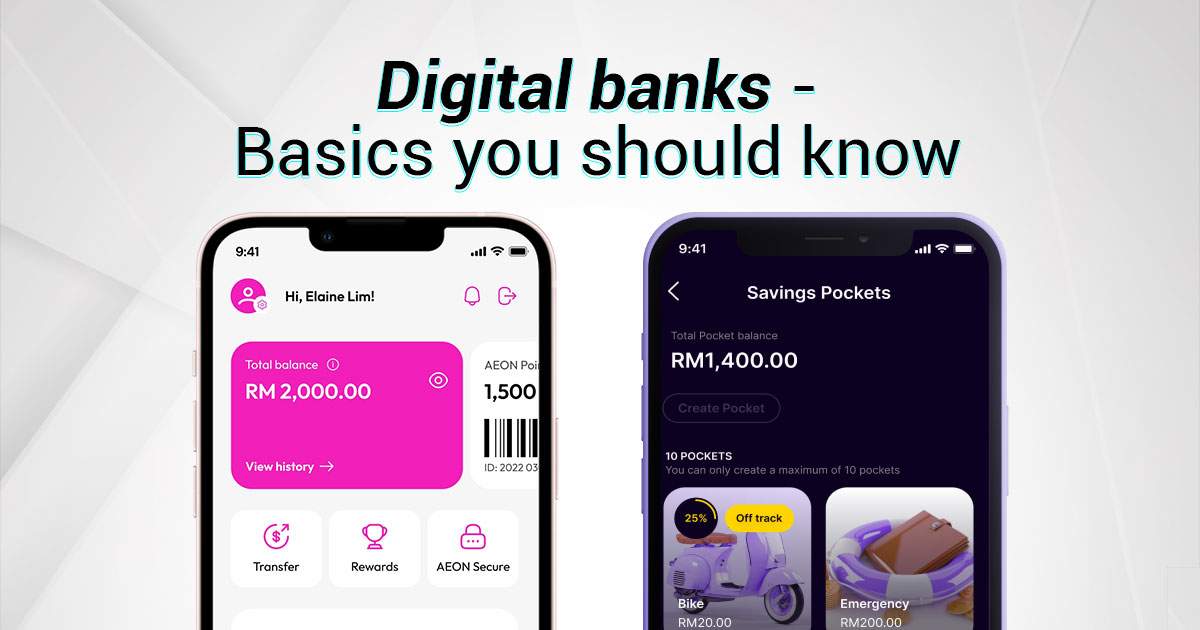

GXBank offers a variety of banking services, all through your smartphone

Some of the benefits offered by AEON Bank

Of course, conventional banks also offer apps or web portals for digital banking like CIMB Clicks, MAE App, RHB Banking and others. These apps allow you to check your bank balance, transfer funds, pay bills and more. However, there is still the need to visit a physical bank branch for banking tasks like credit card renewal and loan applications.

In contrast, digital banks allow you to do everything over the Internet. You no longer need to physically go to a bank because everything can be done on your device. You can also set your transaction limits, withdrawal limits, and permissions for online transactions using the digital bank's app.

What are the benefits of digital banking?

The main advantage of digital banks is convenience because all banking tasks only require you to log in to the digital bank application. Moreover, the tasks can be completed in just a few minutes, regardless of the time of day. There is no need to rush to make an appointment during office hours like a conventional bank.

Digital bank account registration can also be done very quickly. Conventional bank registration requires you to present yourself at a service counter and (often) wait for quite some time. On the other hand, digital bank registration only requires you to download an application and keying in your personal details. Usually, the process can be completed in less than 10 minutes.

With a conventional bank, each physical branch also has operating hours you have to follow

In addition, digital banks offer lower rates and fees, offering a competitive advantage over conventional banks. Digital banks not requiring physical facilities like bank branches or ATM machines is one of the major factors for that.

The convenience offered by digital banks also means that those who don't live near a physical branch or in rural areas can have access to various banking services. Since most of Malaysia, including rural areas, already have Internet coverage, digital banks may be a more suitable option for the residents there.

Will digital bank account holders accept debit or credit cards?

Again, digital banks don't have ATMs and cash/check deposit machines. This means digital bank account holders won't be issued physical debit or credit cards. Some might see this as a boon, as it means you don't have to report lost cards if you lose your wallet or purse.

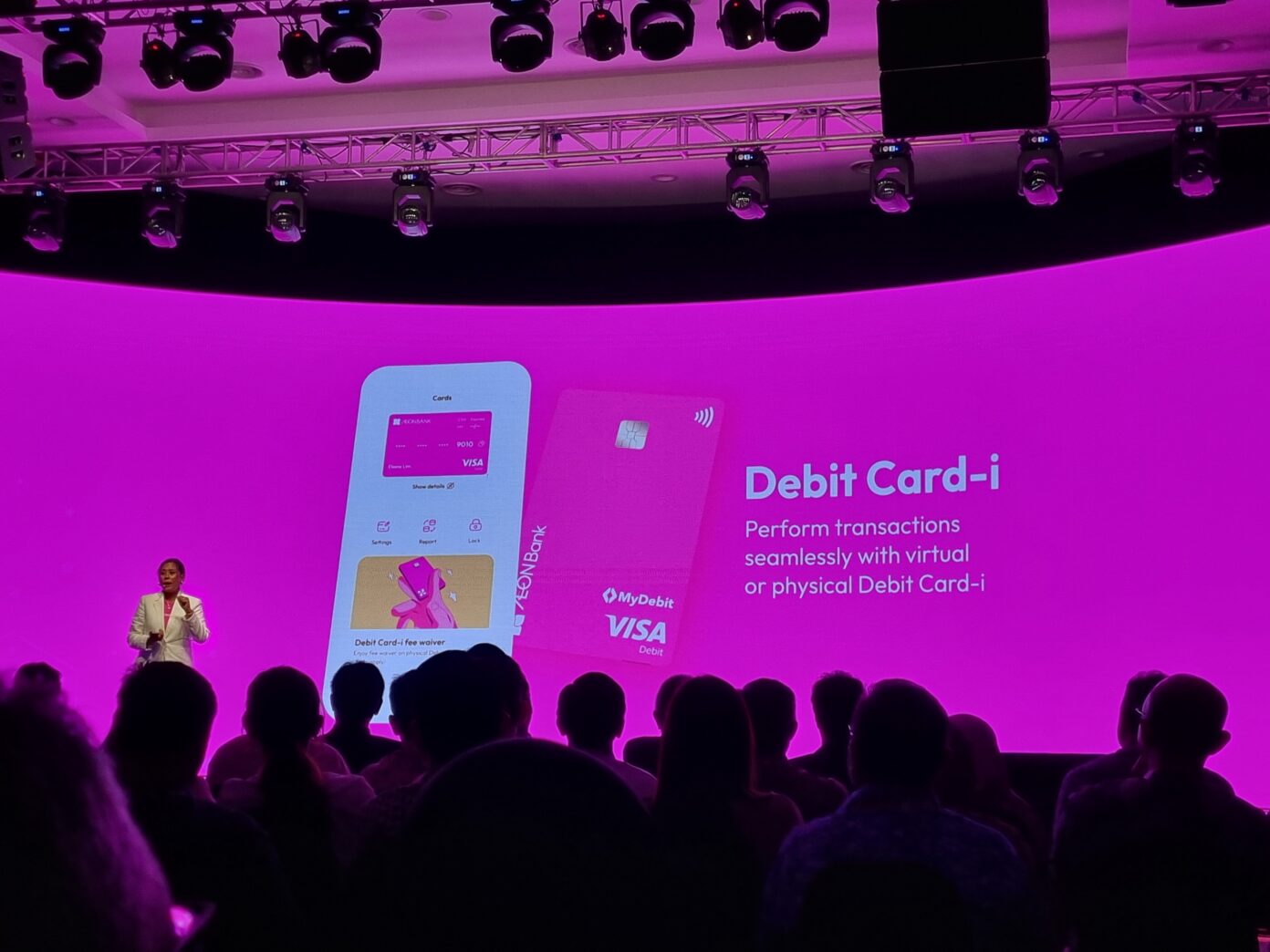

AEON Bank offers virtual or physical debit cards

However, some digital banks allow account holders to apply for a debit card if they are interested. For example, both GXBank and AEON Bank do this. The debit card can be used to withdraw money at ATM machines or make payments at the counter.

Are digital banks safe?

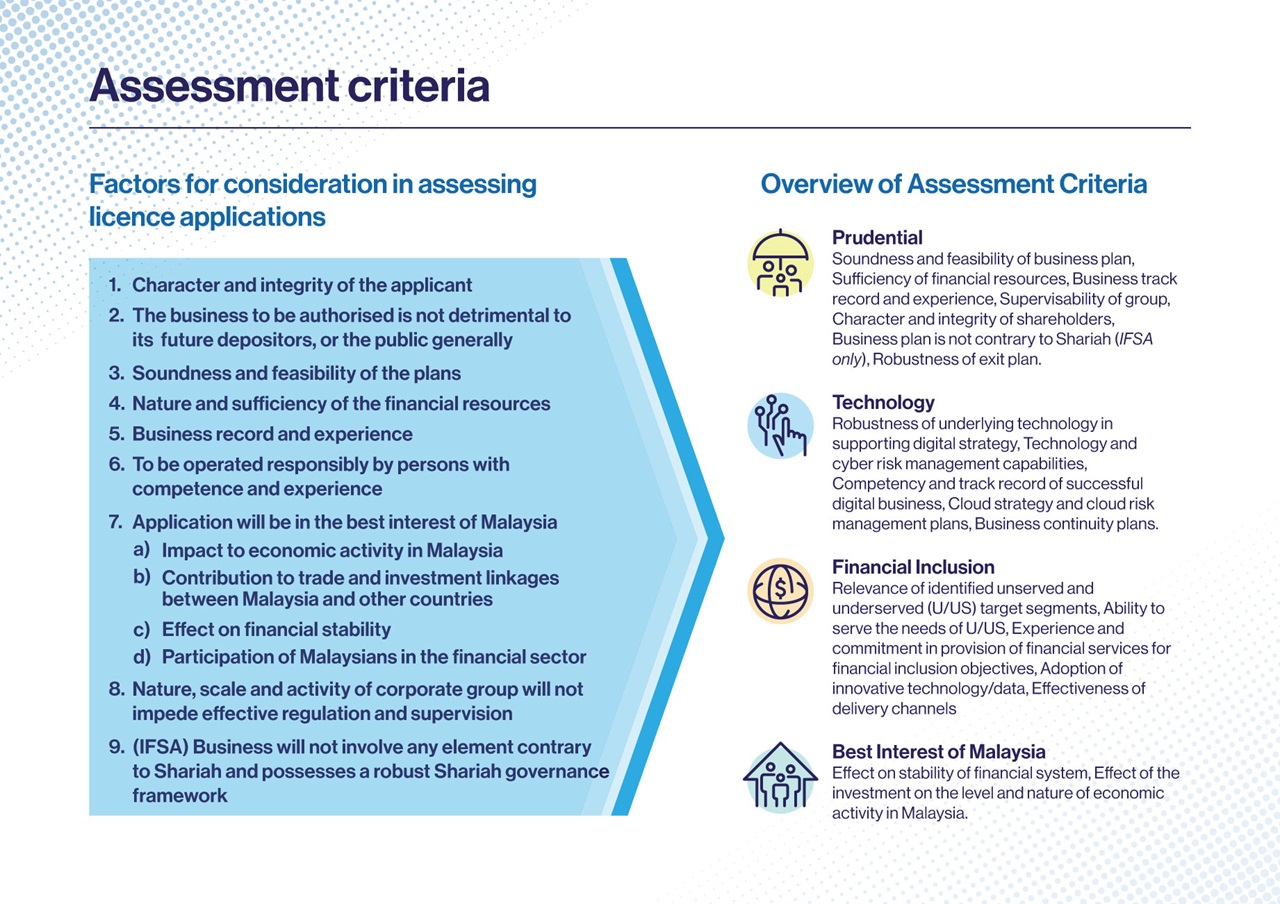

Like conventional banks, all digital banks operating in Malaysia must receive a banking license from Bank Negara Malaysia (BNM) and must meet strict security criteria. These criteria include authority and integrity, adequacy of financial resources, feasibility of business and technology plans, plus the ability to address financial inclusion gaps.

In 2022, BNM reported that out of 29 parties that applied for a digital banking license, only five applicants met the criteria and successfully obtained the license. As of the posting of this article, the number has not changed.

Criteria set by BNM for a digital bank license

Additionally, every digital bank account owner will receive the protection of Perbadanan Insurans Deposit Malaysia (PIDM) for up to RM250000. This means that the money stored in your digital bank account will be safe and guaranteed by PIDM, even if a digital bank ceases to operate. This PIDM protection is the same as that received by conventional bank account holders.

Moreover, each digital bank will ensure a constant, high level of cyber security in its application. These apps often have several special security functions like Two Factor Authentication (2FA), biometric authentication and AES encryption.

Of course, digital banks have the same cyber security risks from hackers or scammers. But the risk of these hacks is small. You still need to remain vigilant and maintain good cybersecurity to avoid becoming a victim of cybercrime.

What are the disadvantages of digital banks?

If you rely entirely on digital banking, you may not be able to perform your banking tasks if the platform is under maintenance. Usually, digital bank maintenance will be done in the middle of the night so that it does not disturb customers during the day. But sometimes, it may happen during the day when you need to do banking tasks. If that happens, you will have to wait until the maintenance is complete.

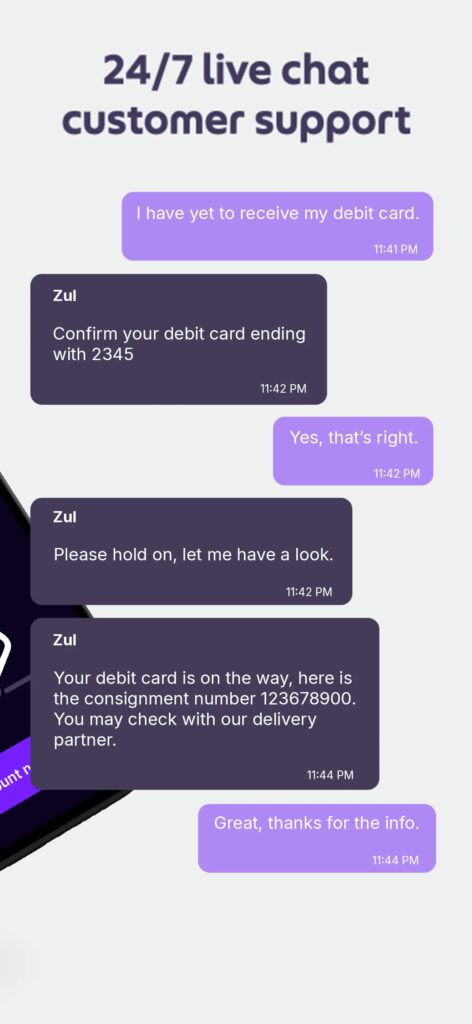

Another possible disadvantage is customer service. When you want to perform a relatively complicated banking task, such as password retrieval, you have to rely on a chatbot or contact a customer service officer by phone or text. This is different from conventional banks, where you can meet a bank officer in a physical branch and get advice that is clearer and best suited to your financial status.

You have to rely on online customer service if you have problems

An individual's grasp of technology could also scare people away from digital banks. For example, people unfamiliar with smartphones or the Internet, especially the elderly, may need a long time to adapt to digital banking.

What digital banks are offered in Malaysia?

Currently, there are three digital banks available for Malaysians. They include Grab's GXBank, AEON Bank by AEON Financial Service, and Boost Bank by Boost and RHB.

All three banks offer most of the same digital bank functions but with their own unique twists. For example, AEON Bank is the first digital bank in Malaysia that practices Islamic banking and is Shariah-compliant. It also offers integration with all AEON shopping centres nationwide. AEON Bank account holders who shop at AEON will receive AEON Points for attractive rewards or cash rewards to be credited to the bank account.

AEON Bank is the first Islamic digital bank in Malaysia

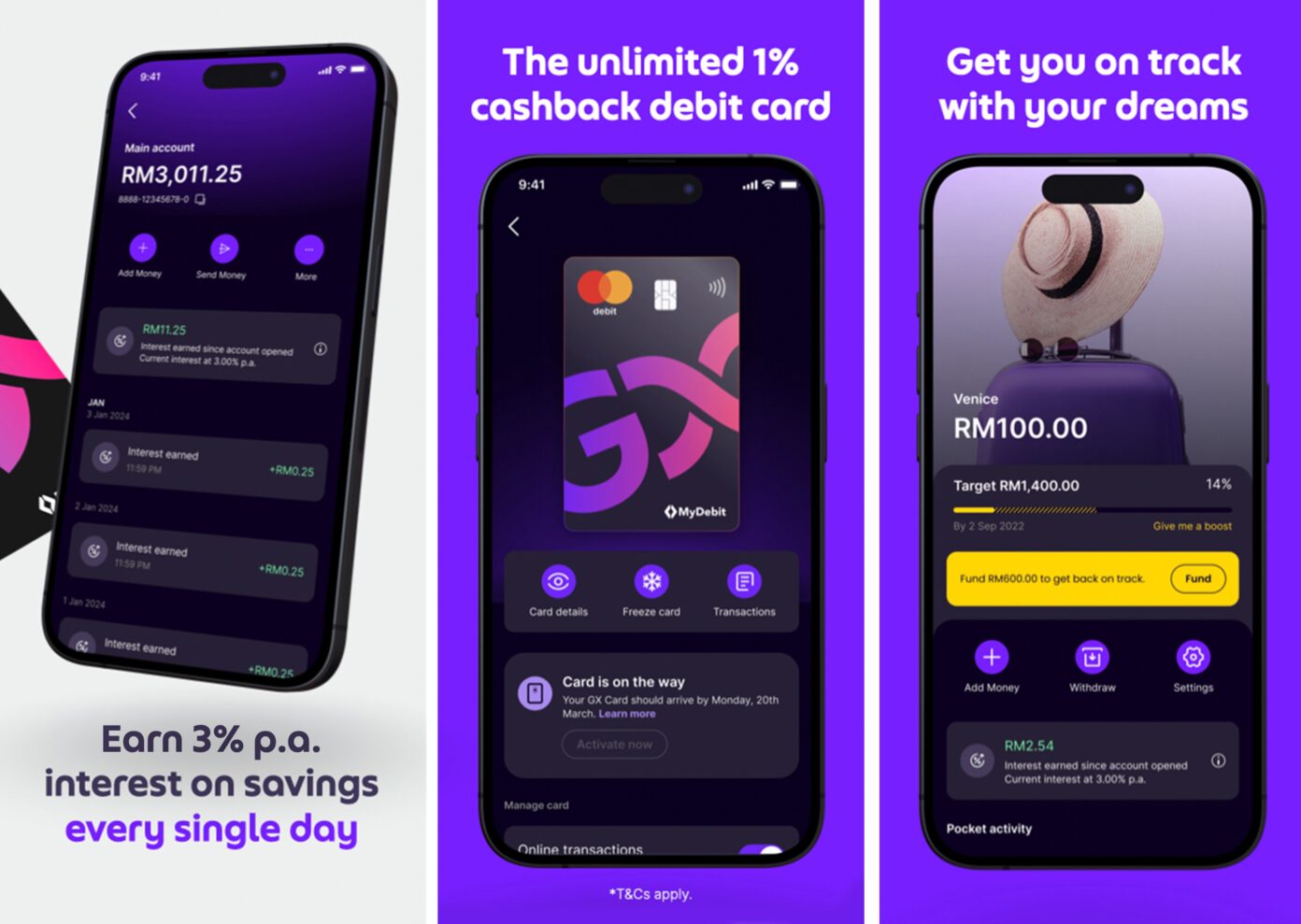

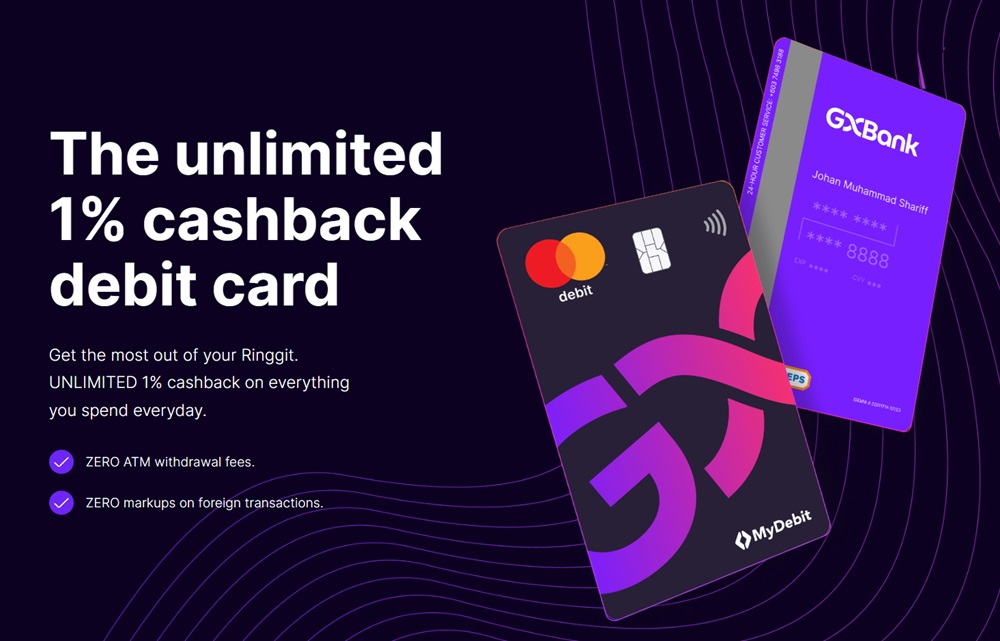

GXBank features a debit card with unlimited 1% cashback

Next is GXBank, which offers an interest rate of 3% per annum daily and unlimited cashback of 1%. While abroad, you can use your GXBank debit card to make payments without any additional charges and also withdraw money from ATMs. It's probably the more travel-friendly digital bank for now.

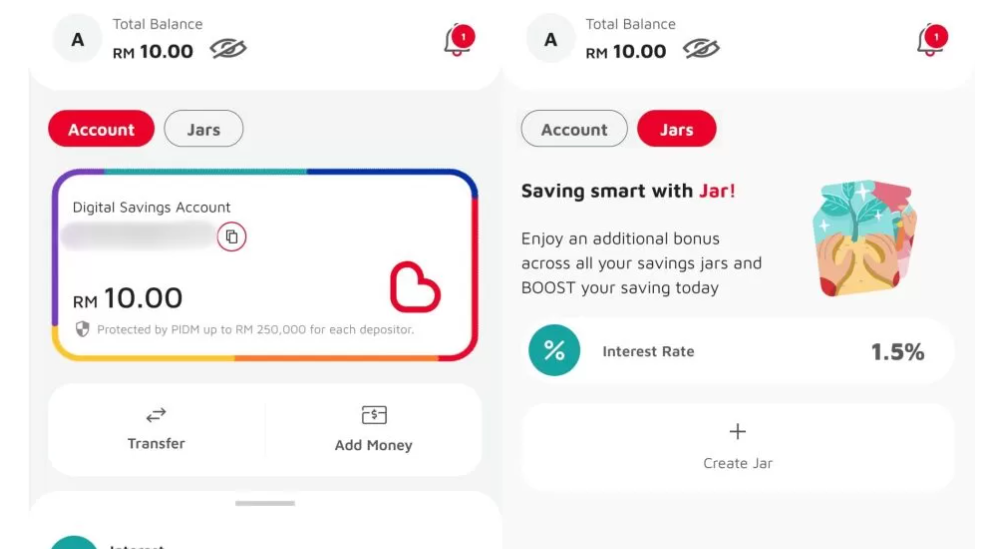

The third one is Boost Bank, which launched on 6 June 2024. Boost Bank is the first digital bank produced in collaboration with a conventional bank (RHB Bank) and owned by a local company. It offers 0.5% pa for deposits below RM2000 and 2.5% pa for deposits above RM2000, as well as a 'Jar' savings service for higher rates of return. If you're trying to save more, this could be the better option.

Boost Bank offer up to 3.6% per annum with Savings Jar

The other two BNM digital banking licensees have yet to begin operations. However, it's confirmed that one is the partnership between GXS Bank Pte Ltd and Kuok Brothers Sdn Bhd. The other licensee is the consortium between Sea Limited and YTL Digital Capital Sdn Bhd.

What is the reception towards digital banks abroad?

If we look at other Asian countries already using digital banks, some have been successful in receiving high responses. For example, Kakao Bank was launched in 2017 and is one of the first digital banks in South Korea. It received hundreds of thousands of registrations within 24 hours of its launch and managed to record profits within two years.

However, digital banks in Hong Kong have not had the same fortune. Since digital banks were introduced four years ago, no digital bank in the region recorded profits. The same is true in Singapore, which already has five digital banks. Of course, digital banks in Singapore were only established last year, so there's still time for results to show.

Therefore, it is too early to make assumptions about the reception of digital banking in Malaysia. If you are interested in digital banks, check out the ones above. Maybe you'll find one that suits your needs and preferences.

With that said, what do you think about digital banks? Let us know in the comments below and stay tuned to TechNave for more articles like this.

COMMENTS